Direct access

Why Impact-Weighted Accounts?

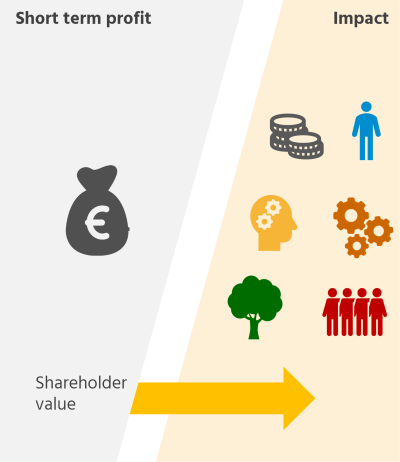

In our current system, financial value is created too often at the expense of society and the environment. We cannot afford to do so. Organisations are moving toward creating sustainable value. In the (near) future, organisations that fall behind risk losing their licence to operate.

Managing sustainable value creation is impossible without measuring it first. However, that is challenging:

- How to reliably measure and compare (non-financial) value?

- How to engage stakeholders and ensure organisations act?

Sustainable value can be measured through impacts. Impacts show how activities affect societal welfare and the natural environment. Impacts can reflect different types of value (financial, manufactured, intellectual, human, social and relationship) and include effects on different stakeholders.

Impact-Weighted Accounts, or IWAs, are a way for organisations to quantify their impacts. The uptake of compiling and publishing IWAs is a key step in the transformation of our economy into an impact economy: a sustainable economy that creates value for everyone.

What are Impact-Weighted Accounts?

Impact-Weighted Accounts (or IWAs) supplement traditional financial accounts. They add information on impacts through quantitative and valued accounts. This shows the value creation or reduction for all an organisation’s stakeholders: employees, customers, the environment and the broader society. IWAs take a broad view on value through Financial, Manufactured, Intellectual, Natural, Social and Human Capital.

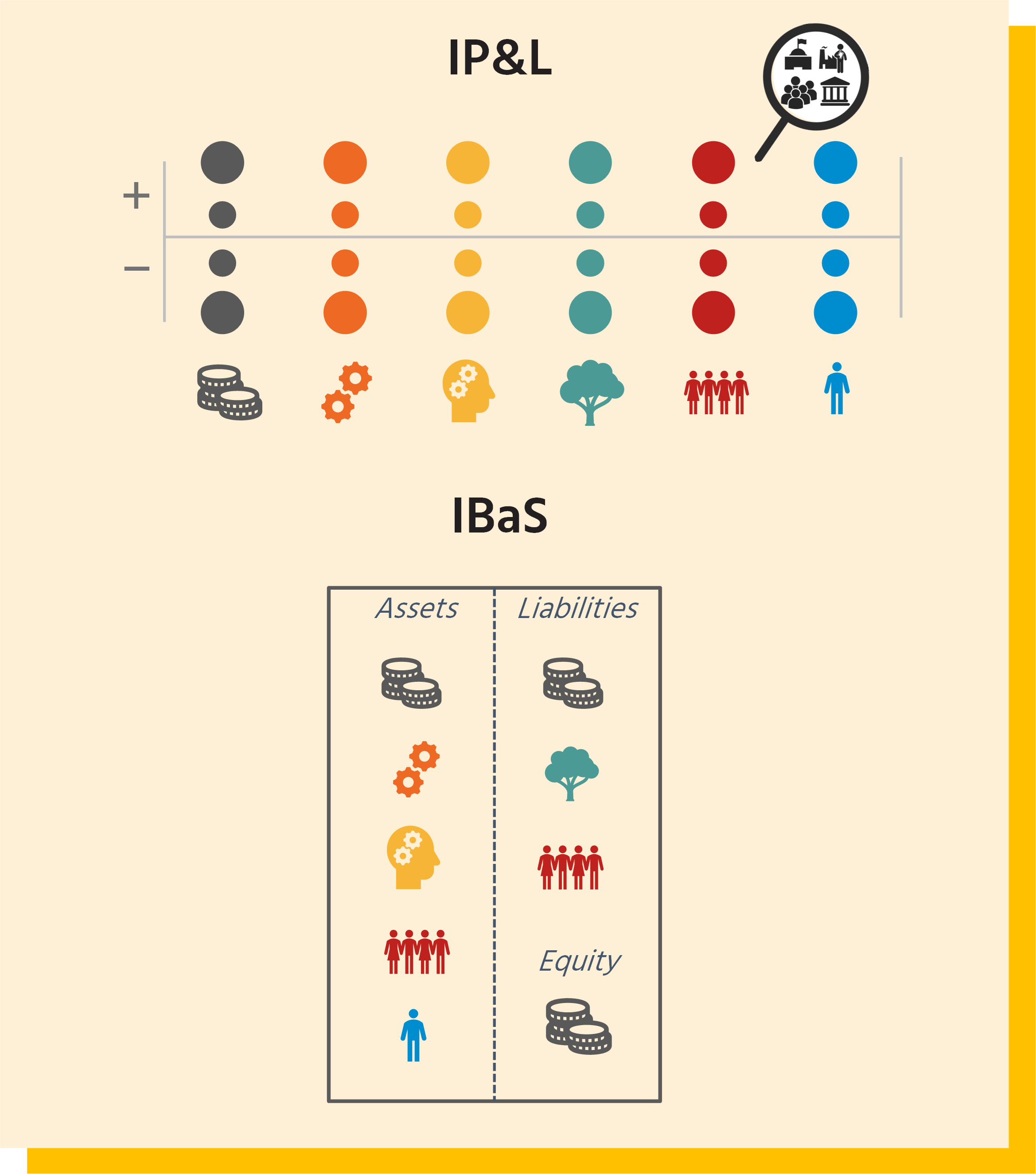

IWAs comprise two key accounts:

- The Integrated Profit & Loss (IP&L) extends the “normal” P&L. It shows all impacts on stakeholders in one year.

- The Integrated Balance Sheet (IBaS) extends the “normal” balance sheet. It shows impact assets and liabilities.

IWAs help companies steer on purposeful and intentional impact that benefit society, while ensuring their own licence to operate.

Why a framework for Impact-Weighted Accounts?

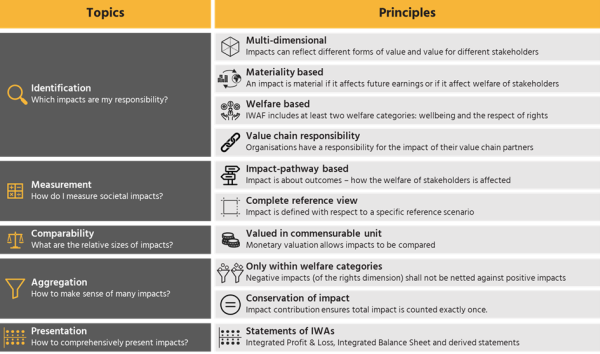

The Impact-Weighted Accounts Framework aims to fill the gap of a missing international standard that ensures complete and consistent IWAs. IWAF builds on concepts from other (non-)financial reporting standards and identified five common topics of (non-financial) impact assessment.

The IWAF answers these common challenges with ten principles to ensure that IWAs inform impact decisions. IWAF’s topics and principles are shown in the figure.

Reading Guide

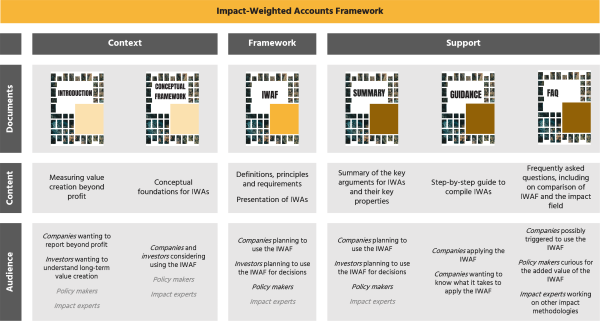

The Impact Economy Foundation is proud to present the Impact-Weighted Accounts Framework (IWAF). The framework itself is supported by (i) two documents that provide context: an introduction and a conceptual framework; and (ii) by three supporting documents: a summary, a guide for practitioners and a FAQ.

The IWAF public consultation was held until September 30th. Results are currently being processed.

Organisations working with IWAF

These organizations measure, report and steer on impact, using IWAF or one of its precursors on which IWAF is based (FIS, IAM, Guide for Funders).

Download the guide

Especially interesting for practitioners. The Summary of the IWAF has been developed to guide organisations and investors in measuring impact and pursuing sustainability and value creation beyond financial value.

This introduction to why Impact-Weighted Accounts are crucial sets the scene for the need to measure beyond financial value creation and capture that in a framework. This

document is to be read in conjunction with the other publications of IWAF.

Especially interesting for impact experts. The conceptual framework for Impact-Weighted Accounts introduces the key concepts. It is to be read in conjunction with the other publications of IWAF.

The Impact-Weighted Account Framework (IWAF) helps organisations to compile IWAs by providing the key concepts, requirements, and guidance.

Especially interesting for practitioners. This guidance document helps to understand each step and stage of an IWA project.

Especially interesting for companies. This paper presents IWAF as a framework for impact management besides impact reporting, supporting companies in integrating their impacts in key business operations with precision and accountability.

This document provides the Standardised list of impacts categories and the list of Monetisation factors.

Acknowledgements

IWAF is written on behalf of the Impact-Economy Foundation by a.o., experts from Harvard Business School, Singapore Management University, Rotterdam School of Management and Impact Institute.

Testimonials

Carlo Cuijpers, Expert, Sustainability Advisory at Van Lanschot Kempen:

The Impact-Weighted Accounts Framework sets a new dot on the horizon. As sustainability reporting is becoming mainstream across the board, it is useful to think about the next frontier, about ensuring impacts are factored in the P&L statements and are reflected in strategic decision making.

Banking For Impact:

The world economy needs a market-based system where social and environmental impacts are just as transparent as financial profit metrics. This means that good banking today requires impact to be measured in a harmonized way. That is why we believe Impact Weighted Accounts are the path forward to re-imagining our economy and will be especially important to financial markets going forward. Banking for Impact builds upon the IWAF and sees this framework as an important next step towards a more sustainable financial sector. One in which social and environmental impacts are just as transparent as financial profit metrics.

Watch again

Webinar – The IWAF in practice: How to apply impact measurement to create value for your organisation

Did you miss our practitioner-oriented webinar on September 1st? You can watch the recording below.

Webinar – The Impact-Weighted Account Framework (IWAF): Paving the way to long-term value creation for all

On June 2nd, the Impact Economy Foundation launched the public consultation of the IWAF. You can watch the recording below.

FAQ

We have prepared a selection of the most pressing Q&A of the passed IWAF-related webinars which can be found in our website by clicking below.