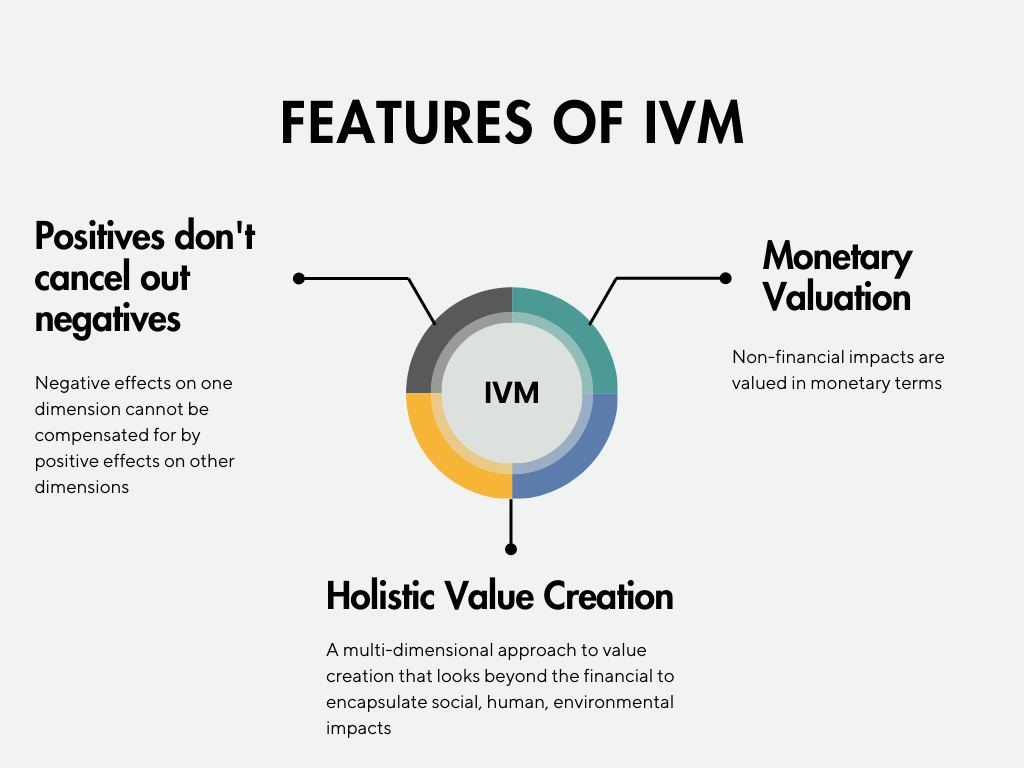

The Impact-Weighted Accounts Framework (IWAF) integrates sustainability impact with financial reporting, offering transparency and enhanced decision-making for Asian organizations. IWAF quantifies impacts in monetary terms and aligns with global sustainability goals, providing a holistic view of corporate influence on society and the environment.

LIANG, Hao | KANG, Mengyao | CHAN, Kam Chee

2024-12-20 (Updated on 2024-12-23)

The Imperative for a Standardized Framework in Measuring Sustainability Impact

With the growing global emphasis on sustainability, a standardized framework is essential for organizations to measure and transparently report their sustainability impact. Numerous frameworks have been developed to guide firms in assessing and communicating their sustainability efforts. For example, the Global Reporting Initiative (GRI) provides a global standard for impact reporting and accountability, emphasizing responsible ESG practices. Similarly, the Sustainability Accounting Standards Board (SASB) supports companies in disclosing relevant sustainability information tailored to industry-specific concerns across 77 sectors. Recent frameworks include the Value Balancing Alliance (VBA) and the International Foundation for Valuing Impacts (IFVI), which together offer methodologies for assessing social and environmental impacts within financial and organizational contexts (Fernandez et al., 2021). Other prominent examples include the International Integrated Reporting Council (IIRC), the Task Force on Climate-related Financial Disclosures (TCFD), and the EU Taxonomy for Sustainable Activities.

Despite these numerous frameworks, stakeholders face challenges due to inconsistent and non-comparable reporting practices. This lack of standardization complicates decision-making, as the metrics reported by organizations may not align with the priorities of external stakeholders. A standardized framework is thus essential for providing a comprehensive and integrated perspective on the impact of reporting organizations.

The article explores how IWAF, developed by the Singapore Green Finance Centre (SGFC) at Singapore Management University (SMU), in collaboration with Harvard Business School, the Rotterdam School of Management, the Impact Institute, and the Impact Economy Foundation, addresses these challenges by offering a comprehensive impact measurement system that integrates sustainability reporting with financial statements. With pilot studies already underway involving leading real estate and financial organizations in Asia, IWAF is poised to transform how companies measure and report their influence on society and the environment.

About the Authors:

- Dr. Hao Liang: A distinguished expert in sustainable finance and the Academic Director of SGFC at SMU, Dr. Liang has published extensively on impact investing and corporate finance in prestigious journals.

- Mengyao Kang: A Research Fellow specializing in corporate social responsibility (CSR) reporting and mergers and acquisitions.

- Kam Chee Chan: A Research Assistant at SGFC actively involved in introducing and implementing IWAF for Asian companies.

Read the full article here: Monetizing and Reporting Impact: Applying an Impact-Weighted Accounts Framework to Asia